Further, it is stated that the reason for the same is that overhead is based on estimations and not the actuals. Suppose that X limited produces a product X and uses labor hours to assign the manufacturing overhead cost. The estimated manufacturing overhead was $155,000, and the estimated labor hours involved were 1,200 hours. Overhead costs are then allocated to production according to the use of that activity, such as the number of machine setups needed. In contrast, the traditional allocation method commonly uses cost drivers, such as direct labor or machine hours, as the single activity. Moreover, predetermined overhead cost rates enhance budgetary control and financial planning by providing a clear framework for managing overhead expenses.

Tools for Managing Predetermined Overhead Rates

Manufacturing overhead costs include all manufacturing costs except for direct materials and direct labor. Estimating overhead costs is difficult because many costs fluctuate significantly from when the overhead allocation rate is established to when its actual application occurs during the production process. You can envision the potential problems in creating an overhead allocation rate within these circumstances. The estimated or budgeted overhead is the amount of overhead determined during the budgeting process and consists of manufacturing costs but, as you have learned, excludes direct materials and direct labor. Examples of manufacturing overhead costs include indirect materials, indirect labor, manufacturing utilities, and manufacturing equipment depreciation. Another way to view it is overhead costs are those production costs that are not categorized as direct materials or direct labor.

Monitoring relative expenses

For instance, if the activity base is machine hours, you calculate predetermined overhead rate by dividing the overhead costs by the estimated number of machine hours. This is calculated at the start of the accounting period and applied to production to facilitate determining a standard cost for a product. The predetermined overhead rate is set at the beginning of the year and is calculated as the estimated (budgeted) overhead costs for the year divided by the estimated (budgeted) level of activity for the year. This activity base is often direct labor hours, direct labor costs, or machine hours. Once predetermined overhead rate a company determines the overhead rate, it determines the overhead rate per unit and adds the overhead per unit cost to the direct material and direct labor costs for the product to find the total cost.

Ethical Cost Modeling

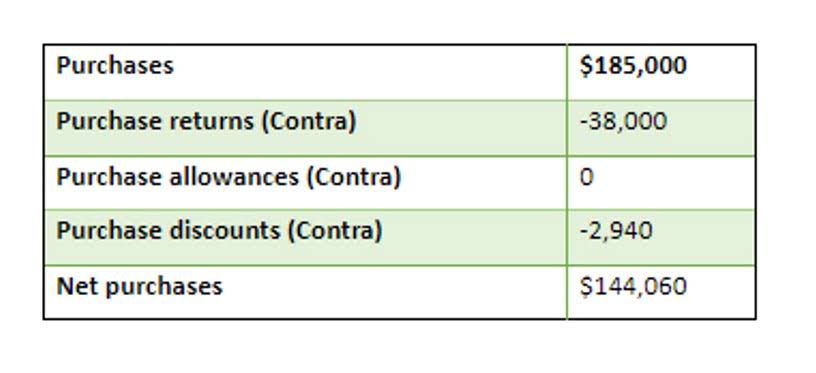

The comparison of applied and actual overhead gives us the amount of over or under-applied overhead during the period which is eliminated through recording appropriate journal entries at the end of the period. Calculating predetermined overhead rates involves estimating total overhead costs and selecting an appropriate allocation base. In summary, predetermined overhead cost rates are a valuable tool in cost accounting that ensures accurate and timely allocation of overhead costs, enhances budgetary control, and supports effective financial planning. The formula for a predetermined overhead rate is expressed as a ratio of the estimated amount of manufacturing overhead to be incurred in a period to the estimated activity Online Accounting base for the period. The predetermined overhead rate formula can be used to balance expenses with production costs and sales. For businesses in manufacturing, establishing and monitoring an overhead rate can help keep expenses proportional to production volumes and sales.

Based on the manufacturing process, it is also easy to determine the direct labor cost. But determining the exact overhead costs is not easy, as the cost of electricity needed to dry, crush, and roast the nuts changes depending on the moisture content of the nuts upon arrival. Different methods are used to apply predetermined overhead rates based on the chosen cost driver. The example shown above is known as the single predetermined overhead rate or plant-wide overhead rate. Different businesses have different ways of costing; some would use the single rate, others the multiple rates, while the rest may make use of activity-based costing.

Whereas, the activity base used for the predetermined overhead rate calculation is usually machine hours, direct labor hours, or direct labor costs. Albert Shoes Company calculates its predetermined overhead rate on the basis of annual direct labor hours. At the beginning of year 2021, the company estimated that its total manufacturing overhead cost would be $268,000 and the total direct labor cost would be 40,000 hours.

- The allocation of overhead to the cost of the product is also recognized in a systematic and rational manner.

- Hence, preliminary, company A could be the winner of the auction even though the labor hour used by company B is less, and units produced more only because its overhead rate is more than that of company A.

- Therefore, the single rate overhead recovery rate is considered inappropriate, but sometimes it can give maximum correct results.

- The predetermined rate usually be calculated at the beginning of the accounting period by relying on the management experience and prior year data.

- However, small organizations with small budgets cannot afford to have multiple predetermined overhead allocation mechanisms since it requires experts to determine the same.

- After going to its terms and conditions of the bidding, it stated the bid would be based on the overhead rate percentage.

- As a result, there is a high probability that the actual overheads incurred could turn out to be way different than the estimate.

- The movie industry uses job order costing, and studios need to allocate overhead to each movie.

- An activity base is considered to be a primary driver of overhead costs, and traditionally, direct labor hours or machine hours were used for it.

- In order to calculate the predetermined overhead rate for the coming period, the total manufacturing costs of $400,000 is divided by the estimated 20,000 direct labor hours.

- Thus the organization gets a clear idea of the expenses allocated and the expected profits during the year.

- The overhead is then applied to the cost of the product from the manufacturing overhead account.

They enable businesses to compare actual overhead costs with the estimated rates, identify variances, and take corrective actions if necessary. This proactive approach to overhead cost management supports better decision-making and resource allocation, ultimately contributing to the overall financial health and efficiency of the business. This method helps in maintaining accurate and up-to-date cost information, which is essential for setting product prices, controlling costs, and analyzing profitability. A predetermined overhead rate is an allocation rate that is used to apply the estimated cost of manufacturing overhead to cost objects for a specific reporting period. This rate is frequently used to assist in closing the books more quickly, since it avoids the compilation of actual manufacturing overhead costs as part of the period-end closing process.

In other words, using the POHR formula gives a clearer picture of the profitability of a business and allows businesses to make more informed decisions when pricing their products or services. In this article, we will discuss the formula for predetermined overhead rate and how to calculate it. The allocation of overhead to the cost of the product is also recognized in a systematic and rational manner. The overhead is then applied to the cost of the product from the manufacturing overhead account. The overhead used in the allocation is an estimate due to the timing considerations already discussed. For example, Catch Up Bookkeeping the recipe for shea butter has easily identifiable quantities of shea nuts and other ingredients.